Get the free form 4506 t

Get, Create, Make and Sign

Editing form 4506 t online

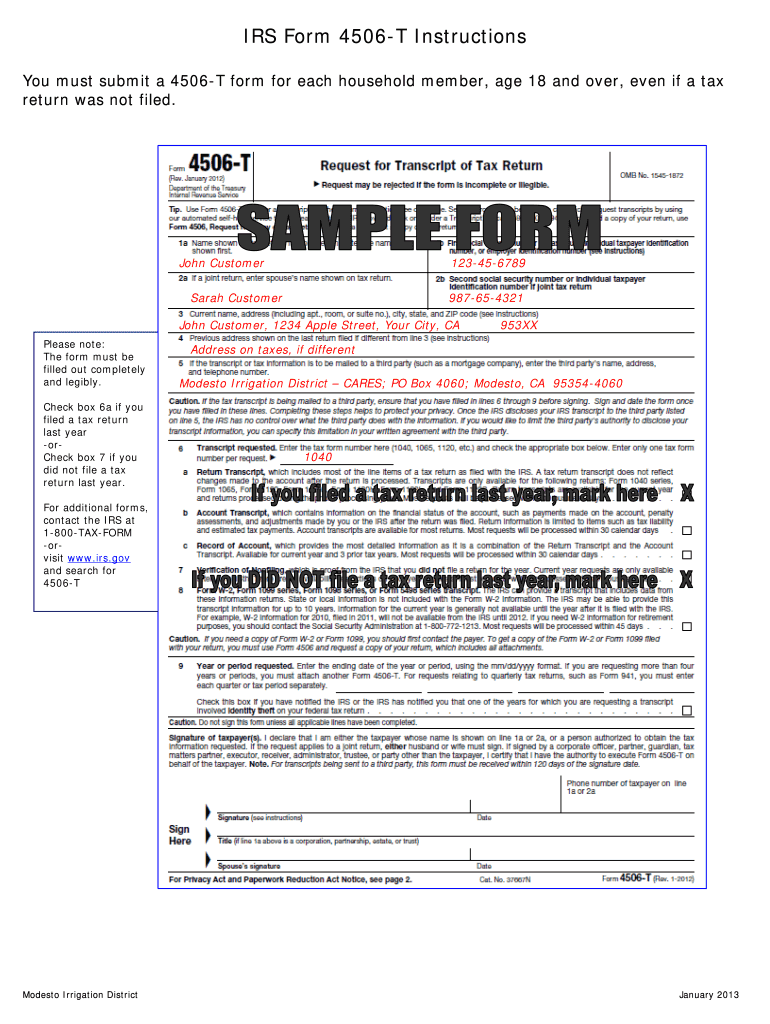

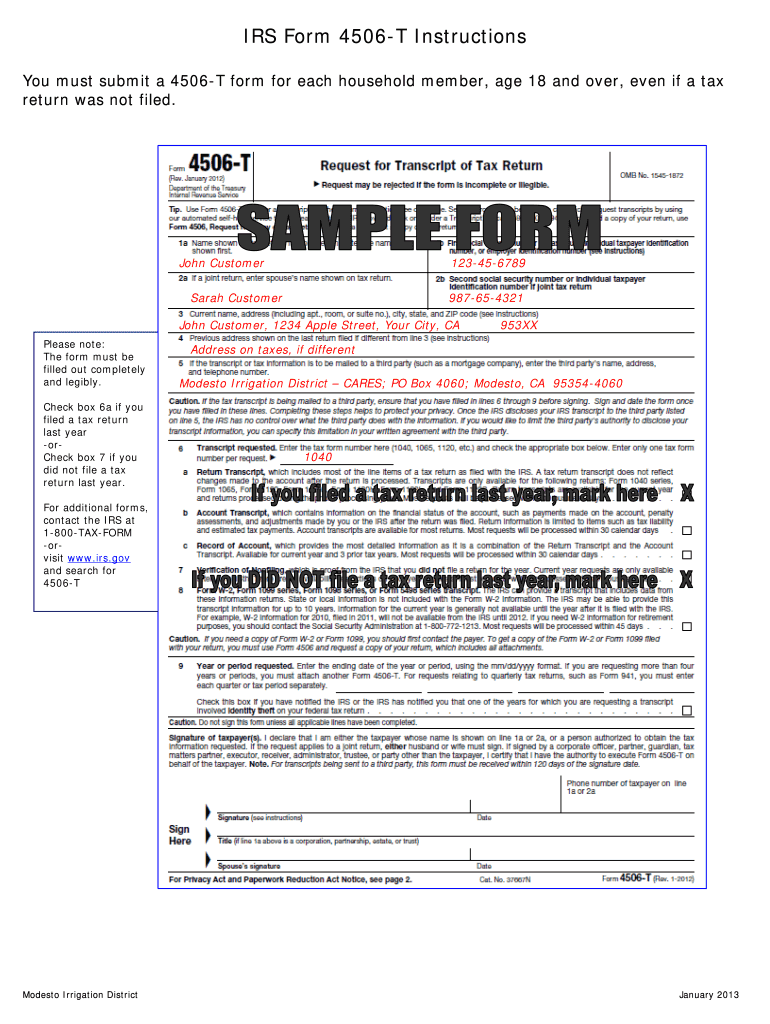

How to fill out form 4506 t

How to fill out form 4506 t:

Who needs form 4506 t:

Video instructions and help with filling out and completing form 4506 t

Instructions and Help about 4506 t form

This message from the National Taxpayer Advocate is intended for individuals purchasing or refinancing real estate hello I'm Nina Olson the National Taxpayer Advocate your voice at the IRS I'm here to give you a consumer tax tip about protecting your personal tax information when you go to the formal closing to purchase a home or refinance a home loan you will undoubtedly be asked to sign a lot of forms well there are some IRS forms that you should be very careful about signing the person working with you to close your loan may require you to consent to disclose certain tax information in order to verify your income you may be asked to sign an IRS Form 4506 T known as the request for transcript of tax return this form gives the lender access to your tax information you may not be aware that by signing an undated form that does not specifically identify the person or entity who will receive your tax information your information may be obtained by any number of entities with access to that form at any time in the future the best way to prevent misuse of your tax information is to limit who has access to this information before signing any documents in connection with alone make sure the documents are complete and that you read them carefully lenders will usually include IRS form 45 o 60 I have asked the IRS to revise these forms and the instructions for those forms to state in clear and plain language that taxpayers should not sign a blank or incomplete form I have also asked the IRS to revise the forms to allow a taxpayer to specify the purpose for which the information can be used by third parties but until the IRS revises these forms please exercise caution and never sign an incomplete form always fill in any blanks completely even if you just write not applicable or cross out the blank and date the form from before signing because this starts the clock running on the 60 days others can use the form to get your tax and information for more information on this topic call 1-800 text form or 1-800 eight to nine three six seven six and request publication 4419 what you need to know the mortgage verification process I'm Nina Olson thanks for sharing your time with me, I care about protecting your privacy as a taxpayer you should too to learn more about protecting your taxpayer rights and the Taxpayer Advocate service please visit our website at WWF contact the Taxpayer Advocate service by calling 187 seven asks TAS one or visit

Fill form : Try Risk Free

People Also Ask about form 4506 t

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 4506 t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.